B) False

Correct Answer

verified

Correct Answer

verified

True/False

If on January 3 a company declares a dividend of $1.50 per share,payable on January 31 then the price of the stock should drop by approximately $1.50 on January 31.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company has a 2-for-1 stock split,its stock price should roughly double.

B) Capital gains earned on shares repurchased are taxed less favorably than dividends,which is why companies typically pay dividends and avoid share repurchases.

C) Very often,a company's stock price will rise when it announces that it plans to commence a share repurchase program.Such an announcement could lead to a stock price decline,but this does not normally happen.

D) Stock repurchases increase the number of outstanding shares.

E) The clientele effect is the best explanation for why companies tend to vary their dividend payments from quarter to quarter.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Your firm uses the residual dividend model to set dividend policy.Market interest rates suddenly rise,and stock prices decline.Your firm's earnings,investment opportunities,and capital structure do not change.If the firm follows the residual dividend model,then its dividend payout ratio would increase.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Underlying the dividend irrelevance theory proposed by Miller and Modigliani is their argument that the value of the firm is determined only by its basic earning power and its business risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

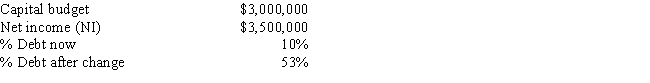

Purcell Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 10% debt.Some Purcell family members would like for the dividend payout ratio to be increased.If Purcell increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend payout ratio be increased,holding other things constant?

A) 28.0%

B) 39.1%

C) 38.3%

D) 31.7%

E) 36.9%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Myron Gordon and John Lintner believe that the required return on equity increases as the dividend payout ratio is lowered.Their argument is based on the assumption that

A) investors are indifferent between dividends and capital gains.

B) investors require that the dividend yield plus the capital gains yield equal a constant.

C) capital gains are taxed at a higher rate than dividends.

D) investors view dividends as being less risky than potential future capital gains.

E) investors prefer a dollar of expected capital gains to a dollar of expected dividends because of the lower tax rate on capital gains.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings a firm pays out in dividends has no effect on either its cost of capital or its stock price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banerjee Inc.wants to maintain a target capital structure with 35% debt and 65% equity.Its forecasted net income is $150,000,and its board of directors has decreed that no new stock can be issued during the coming year.If the firm follows the residual dividend model,what is the maximum capital budget that is consistent with maintaining the target capital structure?

A) $286,154

B) $223,846

C) $230,769

D) $205,385

E) $186,923

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pavlin Corp.'s projected capital budget is $2,000,000,its target capital structure is 40% debt and 60% equity,and its forecasted net income is $850,000.If the company follows the residual dividend model,how much dividends will it pay or,alternatively,how much new stock must it issue?

A) $0;$350,000

B) $378,000;$325,500

C) $287,000;$318,500

D) $325,500;$388,500

E) $381,500;$290,500

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fauver Industries plans to have a capital budget of $600,000.It wants to maintain a target capital structure of 40% debt and 60% equity,and it also wants to pay a dividend of $200,000.If the company follows the residual dividend model,how much net income must it earn to meet its investment requirements,pay the dividend,and keep the capital structure in balance?

A) $560,000

B) $683,200

C) $515,200

D) $632,800

E) $621,600

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm adheres strictly to the residual dividend policy,and if its optimal capital budget requires the use of all earnings for a given year (along with new debt according to the optimal debt/assets ratio) ,then the firm should pay

A) the same dividend as it paid the prior year.

B) no dividends to common stockholders.

C) dividends only out of funds raised by the sale of new common stock.

D) dividends only out of funds raised by borrowing money (i.e. ,issuing debt) .

E) dividends only out of funds raised by selling off fixed assets.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mid-State BankCorp recently declared a 7-for-2 stock split.Prior to the split,the stock sold for $120 per share.If the firm's total market value is unchanged by the split,what will the stock price be following the split?

A) $39.77

B) $34.29

C) $35.31

D) $27.77

E) $41.49

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

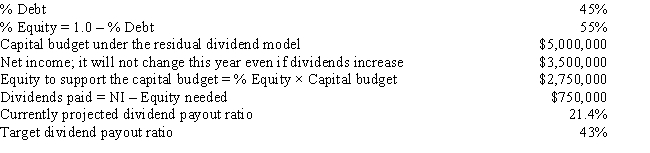

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio? Do not round intermediate calculations.

A) -$1,372,727

B) -$1,098,182

C) -$1,537,455

D) -$1,249,182

E) -$1,496,273

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose a firm that has been earning $2 and paying a dividend of $1.00,or a 50% dividend payout,announces that it is increasing the dividend to $1.50.The stock price then jumps from $20 to $30.Some people would argue that this is proof that investors prefer dividends to retained earnings.Miller and Modigliani would agree with this argument.

B) Other things held constant,the higher a firm's target dividend payout ratio,the higher its expected growth rate should be.

C) Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings that a firm pays out in dividends has no effect on its cost of capital,but it does affect its stock price.

D) The federal government sometimes taxes dividends and capital gains at different rates.Other things held constant,an increase in the tax rate on dividends relative to that on capital gains would logically lead to a decrease in dividend payout ratios.

E) If investors prefer firms that retain most of their earnings,then a firm that wants to maximize its stock price should set a high dividend payout ratio.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sheehan Corp.is forecasting an EPS of $5.00 for the coming year on its 500,000 outstanding shares of stock.Its capital budget is forecasted at $625,000,and it is committed to maintaining a $4.00 dividend per share.It finances with debt and common equity,but it wants to avoid issuing any new common stock during the coming year.Given these constraints,what percentage of the capital budget must be financed with debt?

A) 23.60%

B) 21.60%

C) 22.40%

D) 24.00%

E) 20.00%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whited Products recently completed a 4-for-1 stock split.Prior to the split,its stock sold for $105 per share.If the firm's total market value increased by 4% as a result of increased liquidity and favorable signaling effects,what was the stock price following the split?

A) $26.21

B) $24.57

C) $20.75

D) $27.30

E) $21.84

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mortal Inc.expects to have a capital budget of $600,000 next year.The company wants to maintain a target capital structure with 30% debt and 70% equity,and its forecasted net income is $575,000.If the company follows the residual dividend model,how much in dividends,if any,will it pay?

A) $119,350

B) $175,150

C) $128,650

D) $155,000

E) $190,650

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The federal government sometimes taxes dividends and capital gains at different rates.Other things held constant,an increase in the tax rate on dividends relative to that on capital gains would logically lead to an increase in dividend payout ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Historically,the tax code has encouraged companies to pay dividends rather than retain earnings.

B) If a company uses the residual dividend model to determine its dividend payments,dividend payout will tend to increase whenever its profitable investment opportunities increase relatively rapidly.

C) The more a firm's management believes in the clientele effect,the more likely the firm is to adhere strictly to the residual dividend model.

D) Large stock repurchases financed by debt tend to increase expected earnings per share,but they also tend to increase the firm's financial risk.

E) A dollar paid out to repurchase stock has the same tax benefit as a dollar paid out in dividends.Thus,both companies and investors should be indifferent between distributing cash through dividends and stock repurchase programs.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 75

Related Exams