A) $10.57

B) $0.11

C) $17.89

D) $9.33

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

At an activity level of 6,900 units in a month, Zelinski Corporation's total variable maintenance and repair cost is $408,756 and its total fixed maintenance and repair cost is $230,253. What would be the total maintenance and repair cost, both fixed and variable, at an activity level of 7,100 units in a month? Assume that this level of activity is within the relevant range.

A) $648,270

B) $639,009

C) $650,857

D) $657,531

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Property taxes and insurance premiums paid on a factory building are examples of period costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Abbott Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is $38,000 and if direct materials are $23,000, the manufacturing overhead is:

A) $9,500

B) $152,000

C) $5,750

D) $15,250

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ence Sales, Inc., a merchandising company, reported sales of 6,400 units in April at a selling price of $684 per unit. Cost of goods sold, which is a variable cost, was $455 per unit. Variable selling expenses were $30 per unit and variable administrative expenses were $40 per unit. The total fixed selling expenses were $156,800 and the total administrative expenses were $260,400. The contribution margin for April was:

A) $1,017,600

B) $1,465,600

C) $600,400

D) $3,512,400

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A traditional format income statement organizes costs on the basis of behavior.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

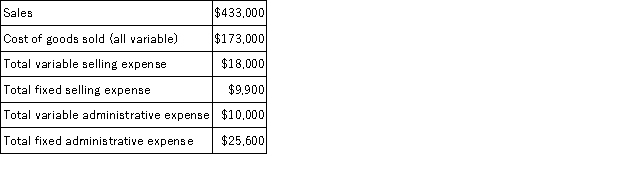

Calip Corporation, a merchandising company, reported the following results for October:  The contribution margin for October is:

The contribution margin for October is:

A) $260,000

B) $232,000

C) $196,500

D) $369,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At a sales volume of 37,000 units, Maks Corporation's property taxes (a cost that is fixed with respect to sales volume) total $802,900. To the nearest whole cent, what should be the average property tax per unit at a sales volume of 40,300 units? (Assume that this sales volume is within the relevant range.)

A) $21.70

B) $20.22

C) $19.92

D) $20.81

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Within the relevant range:

A) variable cost per unit decreases as production decreases.

B) fixed cost per unit increases as production decreases.

C) fixed cost per unit decreases as production decreases.

D) variable cost per unit increases as production decreases.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________________________ is the amount remaining from sales revenue after all variable expenses have been deducted.

A) cost structure

B) gross margin

C) contribution margin

D) committed fixed cost

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a contribution format income statement, the gross margin minus selling and administrative expenses equals net operating income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs, if expressed on a per unit basis, would be expected to decrease as the level of production and sales increases?

A) Sales commissions.

B) Fixed manufacturing overhead.

C) Variable manufacturing overhead.

D) Direct materials.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following costs would be found in a company's accounting records except:

A) sunk cost.

B) opportunity cost.

C) indirect costs.

D) direct costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A direct cost is a cost that cannot be easily traced to the particular cost object under consideration.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emerton Corporation leases its corporate headquarters building. This lease cost is fixed with respect to the company's sales volume. In a recent month in which the sales volume was 32,000 units, the lease cost was $716,800. To the nearest whole cent, what should be the average lease cost per unit at a sales volume of 34,400 units in a month? (Assume that this sales volume is within the relevant range.)

A) $23.20

B) $21.62

C) $20.84

D) $22.40

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Contribution margin equals revenue minus all fixed costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gambino Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $138.80 per unit. The best estimate of the total monthly fixed cost is:

A) $776,400

B) $340,200

C) $812,750

D) $849,100

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following cost data pertain to the operations of Bouffard Department Stores, Inc., for the month of May.  The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores. What is the total amount of the costs listed above that are direct costs of the Shoe Department?

The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores. What is the total amount of the costs listed above that are direct costs of the Shoe Department?

A) $38,000

B) $29,000

C) $70,000

D) $34,000

F) A) and B)

Correct Answer

verified

A

Correct Answer

verified

True/False

A fixed cost remains constant if expressed on a unit basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of direct materials cost is classified as a:

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 187

Related Exams